Notes from Bettendorf Financial Group

Welcome

We want to introduce you to a new member of our team, Amber Taflinger. Amber has stepped into the role of Administrative Assistant to Doug Wier as Shannon is transitioning to full-time Financial Advisor.

Our entire office works toward your financial strategy, so we’re fortunate to have another dedicated, quality team member working with us to help you.

Amber is looking forward to meeting you the next time you’re down at the office. We’re all looking forward to your next visit and answering whatever questions you might have about your financial life.

Older Americans Month

Each May is Older Americans Month, a time to celebrate the wisdom of aging people, recognize their many contributions, and facilitate discussions related to older adults. This year’s observance coincides with the 2023 Retirement Confidence Survey from the Employee Benefit Research Institute (EBRI) and fresh information on Americans’ concerns about their futures.

The survey included over 2,500 American adults, roughly half identifying as retired. One of the headline findings from the survey: 84 percent of the employed and 67 percent of retirees believe that the higher cost of living will make it harder to put money away for their retirement strategy.

While it’s true that the cost of living tends to increase over time, any competent retirement strategy, like the one you’ve created with your trusted financial professional, will have taken this into account. As for the immediate future, inflation numbers are trending downward, meaning that the current squeeze people feel may soon be relieved. That’s good news for those saving today and older Americans enjoying their retirement.

One of the benefits many older Americans possess is hard-earned wisdom. Wisdom means patience to weather difficult times and the good sense to reach out to people who can help. Let me know if you’re concerned about financing your retirement, whether you are approaching that time or an older American yourself. I welcome a conversation about your retirement strategy and how it works for you.

1. acl.gov, May 1, 2023

2. ebri.org, April 27, 2023

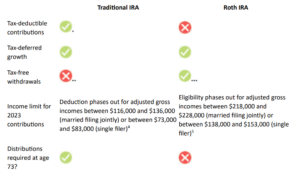

Traditional vs. Roth IRA

Traditional Individual Retirement Accounts (IRA), which were created in 1974, are owned by roughly 36.6 million U.S. households. And Roth IRAs, created as part of the Taxpayer Relief Act in 1997, are owned by nearly 27.3 million households.

Both are IRAs. And yet, each is quite different.

Up to certain limits, traditional IRAs allow individuals to make tax-deductible contributions to their account(s). Distributions from traditional IRAs are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 73, you must begin taking required minimum distributions.

For individuals covered by a retirement plan at work, the deduction for a traditional IRA in 2023 is phased out for incomes between $116,000 and $136,000 for married couples filing jointly, and between $73,000 and $83,000 for single filers.

Also, within certain limits, individuals can make contributions to a Roth IRA with after-tax dollars. To qualify for a tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½.

Like a traditional IRA, contributions to a Roth IRA are limited based on income. For 2023, contributions to a Roth IRA are phased out between $218,000 and $228,000 for married couples filing jointly and between $138,000 and $153,000 for single filers.

In addition to contribution and distribution rules, there are limits on how much can be contributed each year to either IRA. In fact, these limits apply to any combination of IRAs; that is, workers cannot put more than $6,500 per year into their Roth and traditional IRAs combined. So, if a worker contributed $3,500 in a given year into a traditional IRA, contributions to a Roth IRA would be limited to $3,000 in that same year.

Individuals who reach age 50 or older by the end of the tax year can qualify for “catch-up” contributions. The combined limit for these is $7,500.

Both traditional and Roth IRAs can play a part in your retirement plans. And once you’ve figured out which will work better for you, only one task remains: open an account.

Features of Traditional and Roth IRAs

*Up to certain limits

** Distributions from traditional IRAs are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 73, you must begin taking required minimum distributions.

***To qualify, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½.

- ICI.org, 2022

- IRS.gov, 2023. In most circumstances, once you reach age 73, you must begin taking required minimum distributions from a Traditional

Individual Retirement Account (IRA). You may continue to contribute to a Traditional IRA past age 70½ as long as you meet the earned-income

requirement. - Up to certain limits, traditional IRAs allow individuals to make tax-deductible contributions into their account(s). Distributions from traditional

IRAs are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach

age 73, you must begin taking required minimum distributions. - IRS.gov, 2023

- The Tax Cuts and Jobs Act of 2017 eliminated the ability to “undo” a Roth conversion.

Choices for Your 401(k) at a Former Employer

One of the common threads of a mobile workforce is that many individuals who leave their job are faced with a decision about what to do with their 401(k) account.

Individuals have four choices with the 401(k) account they accrued at a previous employer.

Choice 1: Leave It with Your Previous Employer

You may choose to do nothing and leave your account in your previous employer’s 401(k) plan. However, if your account balance is under a certain amount, be aware that your ex-employer may elect to distribute the funds to you.

There may be reasons to keep your 401(k) with your previous employer —such as investments that are low cost or have limited availability outside of the plan. Other reasons are to maintain certain creditor protections that are unique to qualified retirement plans, or to retain the ability to borrow from it, if the plan allows for such loans to ex-employees.

The primary downside is that individuals can become disconnected from the old account and pay less attention to the ongoing management of its investments.

Choice 2: Transfer to Your New Employer’s 401(k) Plan

Provided your current employer’s 401(k) accepts the transfer of assets from a pre-existing 401(k), you may want to consider moving these assets to your new plan. The primary benefits to transferring are the convenience of consolidating your assets, retaining their strong creditor protections, and keeping them accessible via the plan’s loan feature. If the new plan has a competitive investment menu, many individuals prefer to transfer their account and make a full break with their former employer.

Choice 3: Roll Over Assets to a Traditional Individual Retirement Account (IRA)

Another choice is to roll assets over into a new or existing traditional IRA. It’s possible that a traditional IRA may provide some investment choices that may not exist in your new 401(k) plan.

The drawback to this approach may be less creditor protection and the loss of access to these funds via a 401(k) loan feature.

Remember, don’t feel rushed into making a decision. You have time to consider your choices and may want to seek professional guidance to answer any questions you may have.

Choice 4: Cash out the account

The last choice is to simply cash out of the account. However, if you choose to cash out, you may be required to pay ordinary income tax on the balance plus a 10% early withdrawal penalty if you are under age 59½. In addition, employers may hold onto 20% of your account balance to prepay the taxes you’ll owe.

Think carefully before deciding to cash out a retirement plan. Aside from the costs of the early withdrawal penalty, there’s an additional opportunity cost in taking money out of an account that could potentially grow on a tax-deferred basis. For example, taking $10,000 out of a 401(k) instead of rolling over into an account earning an average of 8% in tax-deferred earnings could leave you $100,000 short after 30 years.

1. In most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty.

2. FINRA.org, 2022

3. A 401(k) loan not paid is deemed a distribution, subject to income taxes and a 10% tax penalty if the account owner is under 59½. If the account owner switches jobs or gets laid off, any outstanding 401(k) loan balance becomes due by the time the person files his or her federal tax return.

4. In most circumstances, once you reach age 73, you must begin taking required minimum distributions from a Traditional Individual Retirement Account (IRA). Withdrawals from Traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. You may continue to contribute to a Traditional IRA past age 70½ as long as you meet the earned-income

requirement.

5. This is a hypothetical example used for illustrative purposes only. It is not representative of any specific investment or combination of investments.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.

Eight Mistakes That Can Upend Your Retirement

Pursuing your retirement dreams is challenging enough without making some common, and very

avoidable, mistakes. Here are eight big mistakes to steer clear of, if possible.

- No Strategy: Yes, the biggest mistake is having no strategy at all. Without a strategy, you may

have no goals, leaving you no way of knowing how you’ll get there—and if you’ve even arrived.

Creating a strategy may increase your potential for success, both before and after retirement. - Frequent Trading: Chasing “hot” investments open leads to despair. Create an asset allocation

strategy that is properly diversified to reflect your objectives, risk tolerance, and time horizon;

then make adjustments based on changes in your personal situation, not due to market ups and

downs. - Not Maximizing Tax-Deferred Savings: Workers have tax-advantaged ways to save for

reƟrement. Not partcipating in your employer’s 401(k) may be a mistake, especially when you’re

passing up free money in the form of employer-matching contributions. - Prioritizing College Funding over Retirement: Your kids’ college education is important, but you may not want to sacrifice your retirement for it. Remember, you can get loans and grants for college, but you can’t for your retirement.

- Overlooking Healthcare Costs: Extended care may be an expense that can undermine your financial strategy for retirement if you don’t prepare for it.

- Not Adjusting Your Investment Approach Well Before Retirement: The last thing your retirement portfolio can afford is a sharp fall in stock prices and a sustained bear market at the moment you’re ready to stop working. Consider adjusting your asset allocation in advance of tapping your savings so you’re not selling stocks when prices are depressed.

- Retiring with Too Much Debt: If too much debt is bad when you’re making money, it can be deadly when you’re living in retirement. Consider managing or reducing your debt level before you retire.

- It’s Not Only About Money: Above all, a rewarding retirement requires good health, so maintain a healthy diet, exercise regularly, stay socially involved, and remain intellectually active.

1. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost. Asset allocation and diversification are approaches to help manage investment risk. Asset allocation and diversification do not guarantee against investment loss. Past performance does not guarantee future results.

2. Under the SECURE Act, in most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty.”

3. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost. Asset allocation is an approach to help manage investment risk. Asset allocation does not guarantee against investment loss. Past performance does not guarantee future results.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.

Mark Your Calendars

Tuesday, August 22, 2023 will be the 1st Annual Matt Rueter Golf Outing. Tee times start at 11:30 at Palmer Hills Golf Course, Bettendorf. Stay tuned for more information.